3mint's 2023 Predictions

The 3mint team's predictions for 2023, from a return to fundamentals to NFTs maturing and taking over the world.

Heads up, these predictions are about Web3 and crypto at large, and may contain some technical content—feel free to skip those ones over if it’s not your cup of tea!

With 2022 already well in the rearview mirror, the 3mint team is looking ahead toward 2023—and boy do we have a lot planned for this year! We have been building in the Web3 space since 2017, and investing in its building blocks since even before that. Today, we have more conviction than ever before that we are laying the foundations for the future of commerce and distribution. Brands, enterprises, and even governments have realized over the past couple years in particular that cryptocurrencies, NFTs, and on-chain identifiers are basic building blocks that are value additive and here to stay.

The latest wave of innovation has regrettably also brought its fair share of grifters and exploitative profiteers—but as frauds and scams get exposed and washed out, we are left with sturdier technical foundations and examples of organizations that “get it” (see Nike, Starbucks, Visa, etc.)

And this tide isn’t stopping: a new generation of consumers is coming to age and they are interacting in new channels, with very different expectations. As the paradigm shifts, many of these changes will happen over a period of 5-10 years. With that said, what do we predict will happen in 2023?

1. 2023 is all about getting back to basics. After a downturn like we’ve had in 2022, it’s critical to go through a relearning and refocusing period. We, as an industry, must take stock and ask ourselves the tough questions. It’s absolutely true that the implosion of FTX was a result of fraud perpetrated by centralized actors, of the type you might see at a bank or other centralized institution (no different than Enron, Madoff) —with very little to do with cryptocurrency itself. However, FTX’s collapse points to certain properties of the cryptocurrency “space” that should be reexamined.

Crypto (as a technology) has built-in liquidity. Crypto is also fundamentally decentralized (that’s a good thing!), which means anyone is free to build on it and find ways to exploit the system. This cocktail naturally attracts bad actors. Now, let’s be very clear, crypto protocols like Bitcoin and Ethereum have never had any hacks or exploits; nor have they ever gone down. However, many people have built applications, bridges, and other contraptions on top of these protocols—some of these are poorly constructed and susceptible to attack, others are deliberately designed to attract unsuspecting money. And of course, it’s typically the newest entrants into the space, ie. end users who are often lured by celebrity endorsements (see FTX and Tom Brady, for example) and the promise of quick money (see first point on liquidity), who are at highest risk.

So, we predict 2023 will be a year where there’s more emphasis on the core use cases of Web3 (the things that actually make sense), more efforts towards wallet safety and hygiene, and more education around the risks and benefits of crypto.

2. Ethereum will continue to be the primary place for economic activity on blockchains, and the EVM will dominate in terms of developer activity. In 2022, Ethereum pulled off “the merge,” which was a massive technological feat that saw the Ethereum protocol change its security model from Proof of Work to Proof of Stake, leading to a >99% reduction in energy consumption. This year, more big changes are coming, with the first being what’s called the “Shanghai” network upgrade, which will allow stakers on Ethereum to withdraw their stake whenever they want.

More importantly, we also predict that another big upgrade will happen this year: EIP-4844, which will enable “proto-danksharding.” What the what now? Let’s not get hung up on the term: the important thing to remember is that this upgrade represents the first real, tangible step towards a full sharding implementation for Ethereum, focusing first on L2 enablement. That may still sound like word soup to you, but “sharding” has been a core part of the Ethereum roadmap for some time, and is key to allowing it to scale up to handle large-scale use cases. If you want to learn more about sharding, see here.

There’s some question as to when exactly this will be pushed for release (as it’s been removed from Shanghai), but we’re feeling optimistic that we’ll see it happen by end of year.

3. Back to basics also means focusing on the absolute core of crypto use cases: payments. Make no mistake, the first and most important use case for crypto is the exchange of value on a decentralized, permissionless, and open financial system. We’ve already seen massive growth in crypto rails in developing countries, and I am confident that we’ll see that value increase significantly this year. As Kyle Samani of Multicoin has pointed out recently, we’re also seeing the rise of crypto payments in more specific verticals (as opposed to general purpose); this in fact somewhat mirrors how different payment rails in the traditional payments ecosystem have evolved to meet different needs (credit card for coffee, ACH for rent, for example).

4. NFTs will complete their maturing from purely “outputs” or products, to mostly “inputs”. We might even see the phasing out of “NFTs” altogether for terms like digital collectibles, digital souvenirs, and digital tags. What do we mean by this? NFTs are simply a record of ownership over some piece of data. They’ve become a popular way to indicate ownership over art (such as generative art or PFP avatars) and, by extension, belonging into a community of NFT holders. However, we think their basic premise as a standard of ownership online unlocks orders of magnitude more potential.

As brands offer digital collectibles to their consumers, they’ll get a better understanding of their users, their transaction data, their affiliations and credentials, and the communities they choose to opt into. That will supercharge gamification, personalization, and collaboration, painting a very compelling future.

Does that spell the end of “blue chip” PFPs and generative art NFTs? Not quite—in fact, we expect to see more consolidation at the top, with value accruing to more lindy assets that have cultural credibility and real communities to back that up—see Crypto Punks for example. And of course, we love generative art and believe it’s a core pillar of NFT culture. Moreover, NFTs remain a powerful tool for creators to seamlessly monetize their art, music, and beyond.

5. More collaboration across brands and creators facilitated by Web3. To extend the previous point in more practical detail, the power of digital collectibles will become apparent as more brands issue them and as more users collect them; their prevalence will allow brands and other entities to use them as inputs into how they target and engage with users. It will become easier than ever for two (or more) brands, or for a brand and a creator, to collaborate on the basis of an overlap in users who share similar interests (as expressed by their NFTs on chain). In a matter of clicks, a brand can create a campaign that appeals to the superset of “fans of Beyonce” and “Adidas fans”. (Psst, this is what we do at 3mint! Get in touch here.)

We predict this dynamic is going to power a whole new wave of crossovers—and we’ve already seen a glimpse with this week’s announcement of the Nike x Tiffany & Co. collab. Expect to see way more of this soon.

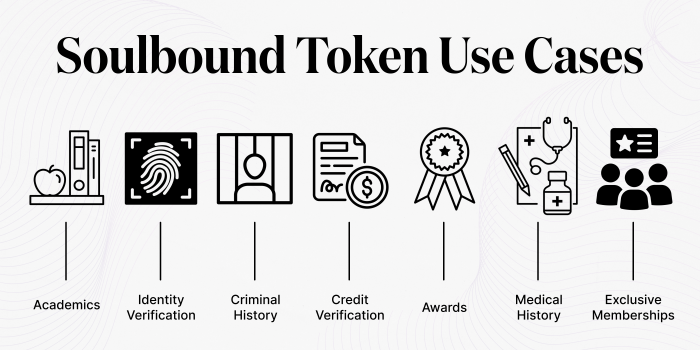

6. Dynamic NFTs and Soulbound NFTs (SBTs) will lead to new constructs and design patterns. What we love about this space is how it never stagnates, at least not from a technological standpoint. Beyond the early ERC721 standard, we’ve seen a constant evolution in how NFTs are used and crafted. Two major developments that will continue to shape the space in 2023 are dynamic NFTs and Soulbound NFTs. The former allows for NFTs to automatically change in form and behavior based on external triggers. For example, imagine that an NFT avatar in a game evolves (like a Pokemon!) once you (the player) have completed a certain number of quests.

Soulbound NFTs, as described by Vitalik here, and then elaborated upon in this paper with Glen Weyl and Puja Ohlhaver, refer to NFTs that are non-transferrable. They can be used for rewards that can be earned but not bought, and in some cases have utility for on-chain identity and reputation. They are not a blanket solution for identity on chain (in fact sometimes quite the opposite, as Evin McMullen of Disco likes to remind us!), but in some cases, like what KYC DAO is building, can be quite useful.

7. Digital twins will become a default piece of the product for many luxury and fashion brands. As Nic Carter described in his piece “Redeem-and-retain NFTs are the future of luxury goods,” eventually purely analog “physical world” goods will seem outdated, and they’ll feel naked without their digital counterparts. This makes sense for the simple reason that we live more and more of our lives online. If you can flex your Rolex IRL, you should be able to flex it in whatever digital format you choose to spend time in.

Beyond that, the digital twins can have their own benefits. They can act as the key to unlock digital community and digital perks offered by the brand, and they can also store data associated with the use of the physical product. Moreover, we also predict the relationship can be reversed: instead of the NFT being a digital twin of the physical product, we’ll see more brands experimenting with a digital-first approach, in the same way Forever 21 has started to do within Roblox, where they are able to test the demand for certain physical products based on interest in the digital version first.

8. Decentralized Social (DeSo) will continue to gain traction. The past couple years have contained plenty of catalysts for DeSo, from deplatforming of controversial public figures, to uncertainty over the future of Twitter since Elon Musk showed interest in purchasing the platform. Now, the cat is out of the bag, and a set of primitives have been built that is fostering a burgeoning ecosystem. Tools like SBTs, DiDs and VCs, Lens Protocol, and ENS represent the building blocks, while apps (upon protocols) like Farcaster are packaged to compete directly with the likes of Twitter.

We predict further growth and more experimentation in this area, and are especially optimistic about the development activity around Lens Protocol. In parallel, we expect some brands and enterprises to allow sign-in with Ethereum or some form of authentication based on Ethereum or Lens.

9. A triple-A game will come out with digital assets that players can earn, trade, and export to external environments. “GameFi” has been thrown around rather liberally in the past year as a major catalyst for mainstream crypto adoption. Only one problem: the Web3 games so far are generally a very poor and boring user experience. Most of these so-called games were built as financial treadmills where the goal is to turn money into more money through aimless clicks; when the in-game currency that sustains the momentum inevitably collapses, players realize they were only playing the game to earn money. That’s when those games cease to exist.

That doesn’t have to be the case, however. Let’s remember that digital assets are an enabling technology; while they won’t make your game a winner if the gameplay isn’t enjoyable to begin with, they are genuinely value-additive to games that are worth playing. We predict that we’ll see a truly great game released this year that has these properties.

10. Regulatory reflection and retaliation, but not quite yet clarity.

Following the calamities of FTX and Terra/Luna before it, 2023 will be a year of reckoning for many projects that have skirted or outright eschewed their jurisdiction’s laws and regulations. US authorities in particular have already indicted several individuals, and it’s just the beginning—especially as the effects of the FTX contagion are far from over. A few more dominoes need to fall before we can consider this episode resolved.

We predict that in 2023, we will see several indictments, and several proposals for regulation from lawmakers and agencies in the US and Europe. However, we have a feeling like we won’t quite get complete clarity just yet. That sounds more like 2024.

That’s it for now. Stay tuned for more on how to best position yourself as a brand in this dynamic industry!

About 3mint

3mint is the all-in-one Web3 customer engagement platform for brands, with a toolkit of enterprise-grade APIs and SDKs that enable brands to build any Web3 product or experience at scale—without any of the complexity associated with blockchains. Get in touch with us here.